No, time is not on Russia‘s side

Facing Russia’s war of aggression against Ukraine, the European Union has so far unanimously agreed on 13 sanctions packages– the biggest sanction effort it has ever made. These sanctions have been also closely coordinated with many like-minded partners. However, we have often heard in recent months that these unprecedented sanctions may not be working. Those voices were particularly loud following the announcement by Russian authorities of a 3.6 % GDP growth in 2023.

Caution with official figures in Putin’s Russia

First, in an autocracy like Russia, where freedom of information and checks and balances do not exist, one must always exercise great caution with official figures. Economic ones are as suspect as the voting results of the last presidential election. Second, it was unlikely from the outset that the Russian economy would collapse after the invasion of Ukraine. Over the past two years, we have consistently stressed that the effect of our sanctions would not be immediate and that their aim was to weaken Russia's ability to support its war effort on the medium term. And that is in fact what is beginning to happen.

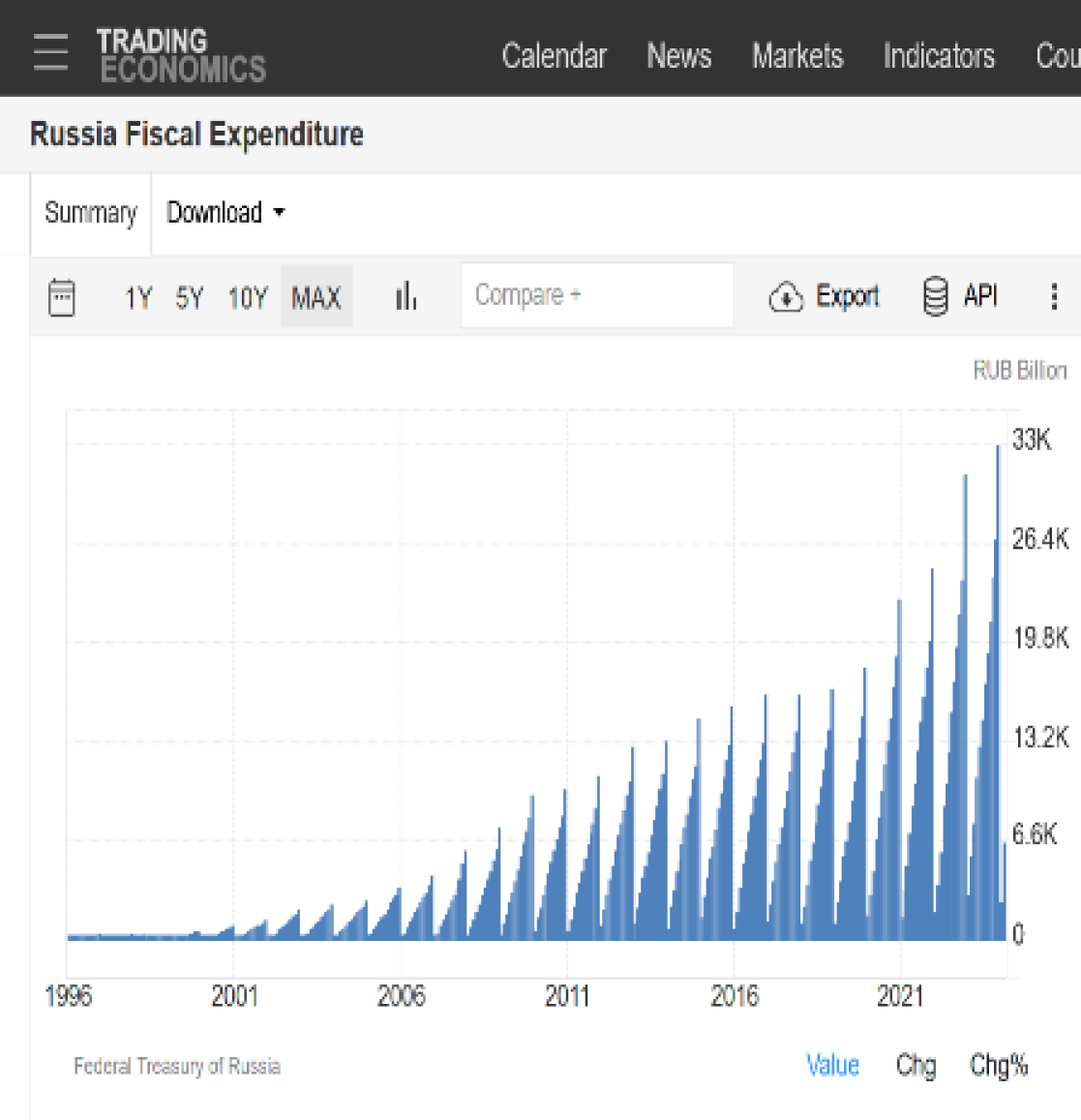

Source: Federal Treasury of Russia

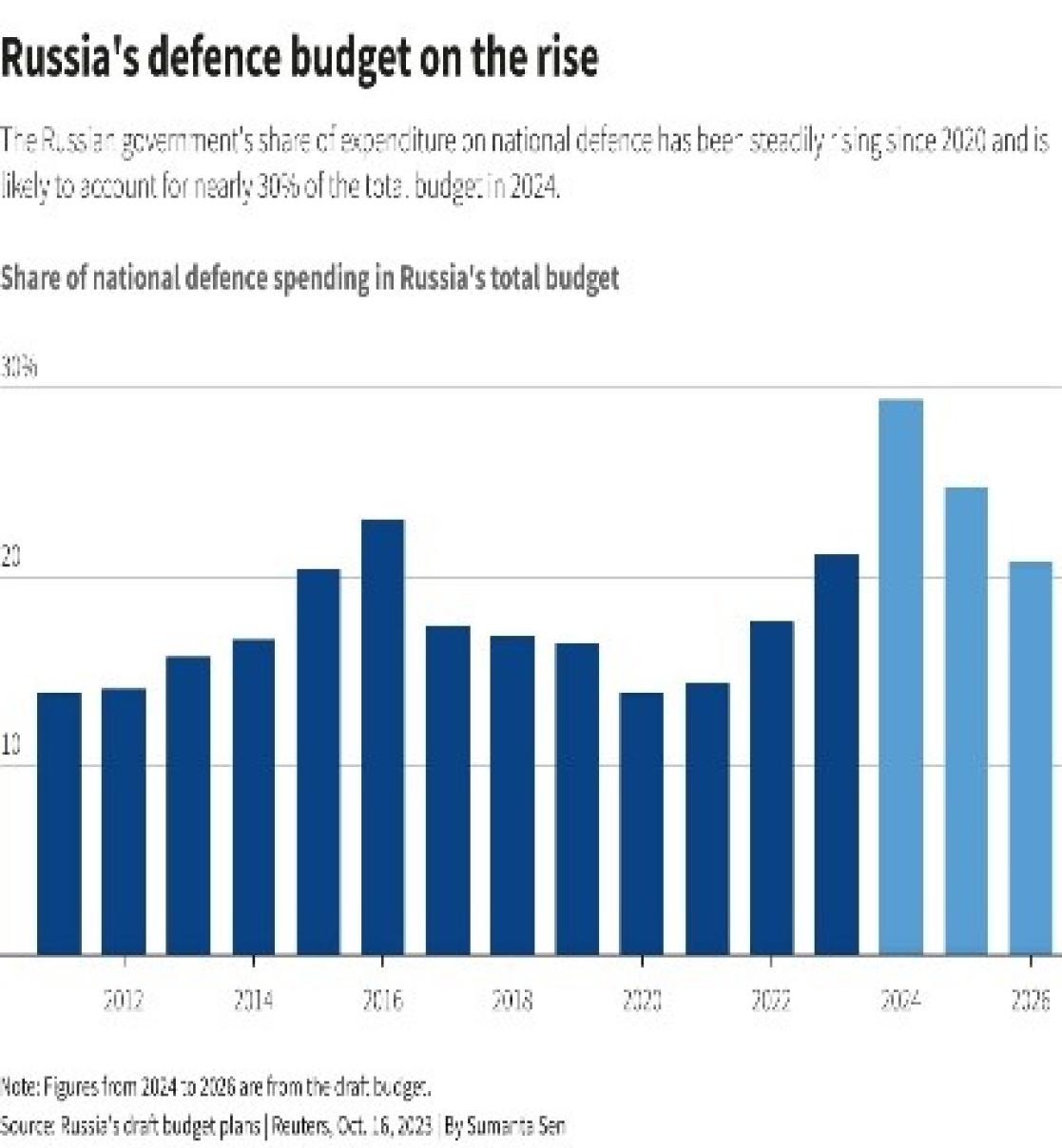

Source: russia's draft budget plans, Reuters, Oct. 16 2023 by Sumanta Sen

“The economic growth recorded in Russia in 2023 was the classic result of a policy of 'wartime Keynesianism' already seen in Germany in the 1930s.”

The economic growth recorded in Russia in 2023 was the classic result of a policy of "wartime Keynesianism", which was already seen in Germany in the 1930s. With a 70 % increase in 2024 defence spending compared to the previous year, some 30% of Russia’s budget and 6 % of its GDP are now officially dedicated to national defence with important additional resources earmarked as classified expenses. Military and security spending are back to Soviet era levels.

The Russian economy fuelled by the explosion of defence spending

The Russian economy has been fuelled by this explosion of defence spending, including high payments to soldiers and the families of those killed in Ukraine, especially in ethnic minorities in the poorer regions. This dynamic is also reflected in regional economic imbalances, with regions with strong military industries or bordering Ukraine showing better economic performances, due to war-related activities.

For an authoritarian regime like Putin’s Russia, it is relatively easy to redirect the economy towards military production, albeit with massive negative consequences for other sectors. The shift towards a war economy necessarily means much less spending on education, health, social security, roads, civilian infrastructure, energy systems… This reorientation has already negatively affected lives of many ordinary Russian citizens as we witnessed, for example, with many defects of collective heating systems in several Russian towns last winter. If the war continues, it will only get worse.

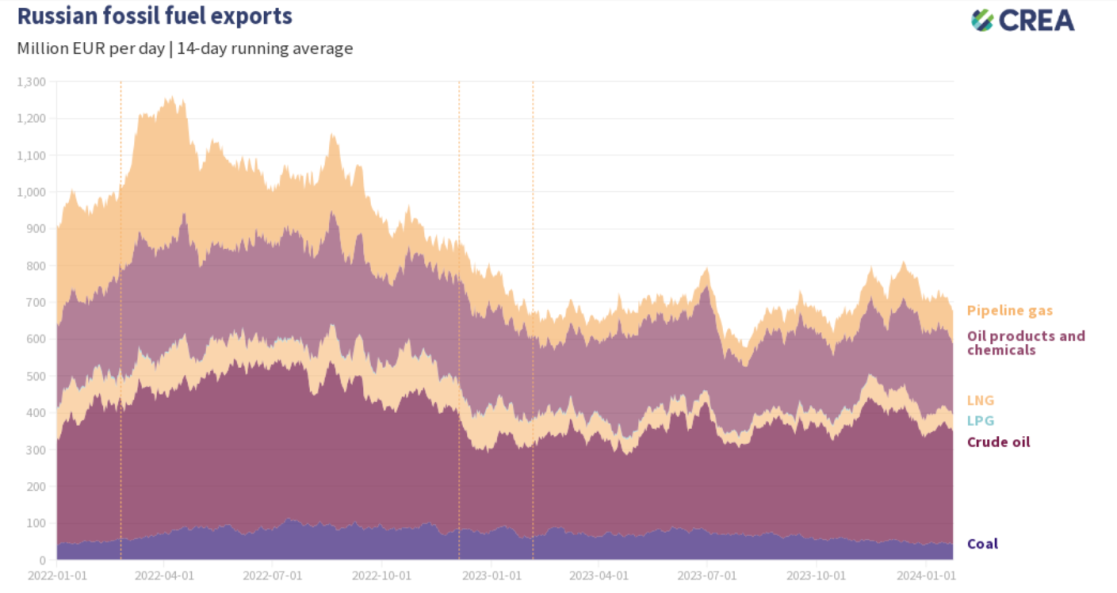

CREA, 2024

CSR, 2024

“The revenue that the Russian economy derives from fossil fuel exports has halved since spring 2022.”

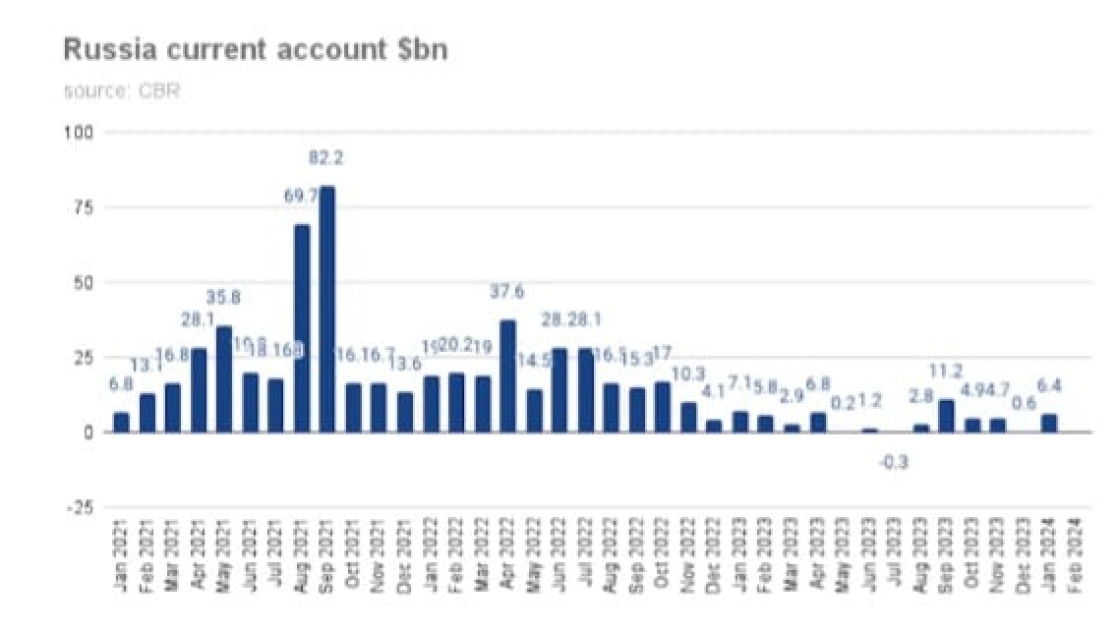

Our sanctions are also already hitting Russia’s purse. The revenue that the Russian economy derives from fossil fuel exports has halved since spring 2022 thanks to the European embargo on coal and oil and the price-cap decided by the G7 on oil exports. Our objective has never been to prevent Russia from exporting fossil fuels, which would have triggered a major crisis on the world energy markets. It was to significantly reduce Russia’s profits from these exports and we have achieved this goal. This is evidenced by trade figures: as a major fossil fuel exporter, Russia has traditionally had a huge external surplus. However, over the past two years, this surplus has shrunk to almost zero.

Federal State Statistics Service, 2024

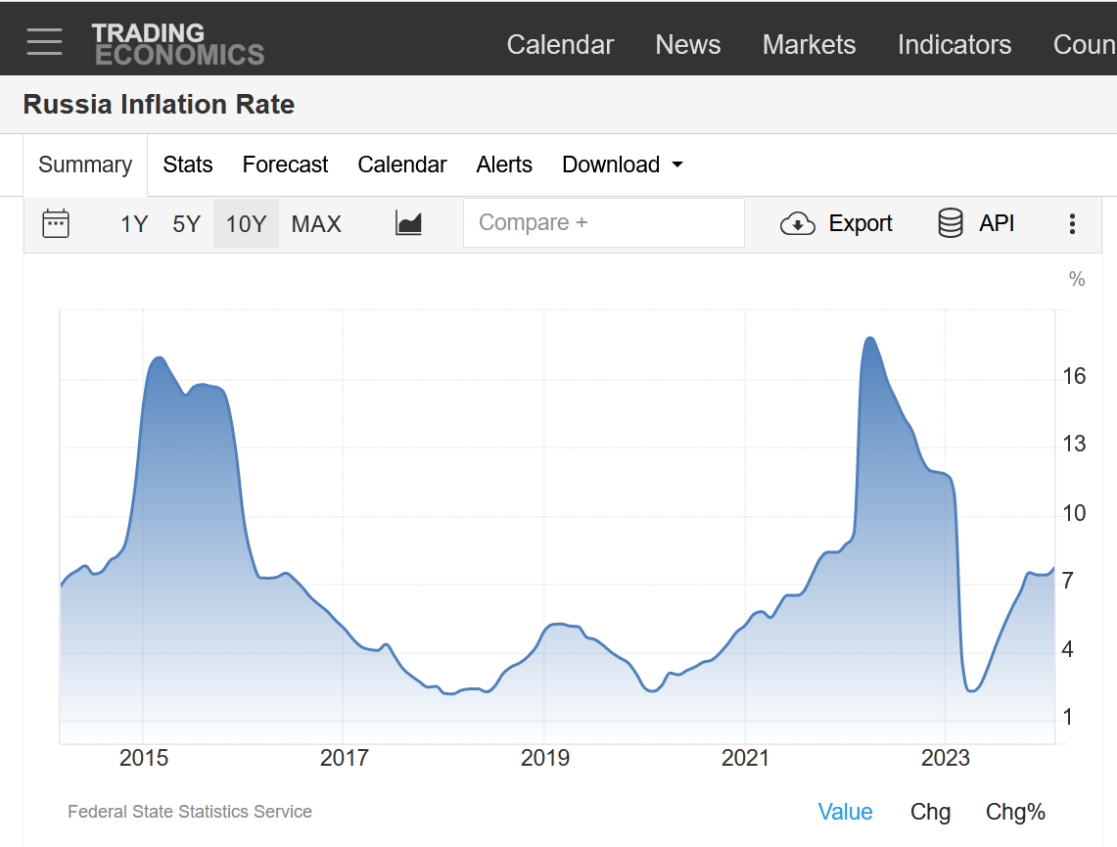

In Russia, inflation is high

In 2022, the Russian economy also experienced a sharp rise in inflation, largely due to Western sanctions. In the first half of 2023, inflation had eased considerably, only to rise again since mid-2023. Currently, annual inflation rates in Russia surpass 8%, compared to the 2.6% seen in the Eurozone. This has been particularly true for food prices, with for example a 40 % rise in the price of eggs in 2023, a staple food for many Russians. The expenses for meals in the budget of an average Russian family has increased to more than 30% of the total.

Google, 2024

Since spring 2022, the rouble has also been falling steadily. This devaluation makes imports more expensive. To halt this fall of the Russian currency and the resurgence of inflation, the Russian Central Bank has been compelled to sharply increase its short-term interest rates, which now stand at 16% a year, 3.5 time the European Central Bank interest rate. The massive war-related spending, higher costs of imports, and a tight labour market mean that inflation in Russia will remain elevated forcing the Central Bank to keep interest rates at high levels.

“With very high interest rates, private investments in Russia are severely impacted and the Russian State itself can ill afford to borrow. The consecutive lack of investment will further dent Russia’s economic future.”

At the same time, investor confidence in the future of the Russian economy is so low that the Russian government must borrow at a 10-year interest rate of almost 14% a year, compared with an average of 2.9% in the Eurozone. Russia has already experienced significant capital flight and even those who Russia labels as ‘friendly’ countries are not eager to bet their money on the future of Russia. With interest rates at such a high level, private investments in Russia are severely impacted and the Russian State itself can ill afford to borrow. The consecutive lack of investment will further dent Russia’s economic future.

Working to limit circumvention of sanctions

It is a recognised fact that our sanctions are partially circumvented, in particular through exports of products to Russia's neighbours, which are then re-exported to Russia. In response, together with our G7 partners, we are constantly working on limiting such circumvention, aiming at holding all players in the supply chain accountable, notably banks that contribute to such transactions. These efforts are becoming more and more effective. However, even despite partial circumvention, it has become much harder for Russia to obtain the products it needs to wage its war, especially high-tech products. Russia now manages to obtain only a fraction of what it would need and at much higher prices than before February 2022.

“Despite partial circumvention of our sanctions, Russia now manages to obtain only a fraction of what it would need and at much higher prices than before February 2022.”

This difficulty is already reflected in official Russian statistics. In the Russian national accounts, investment spending has jumped by more than 20% since the beginning of its war of aggression against Ukraine. However, this is not a sign that the Russian economy is modernising at breakneck speed. On the contrary, the volume of actual investment has probably decreased significantly. This jump in investment expenses reflects mostly the sharp rise in the price of the capital goods that Russia still manages to import.

Jonathan McDowell, planet4589.org

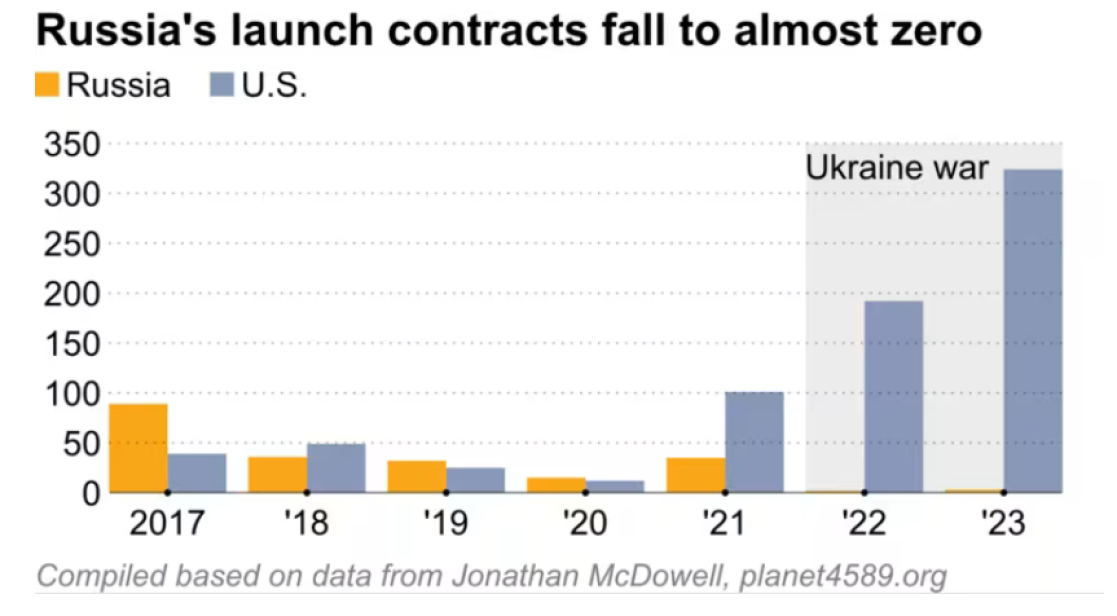

Despite the ability of the Russian authoritarian regime to massively redirect the production of the country's economy towards weapons and ammunition production, its dependence on countries like Iran or North Korea to provide enough drones, ammunition or missiles to sustain its war effort reflects also a persistent industrial weakness aggravated by Western sanctions. The production of cars in Russia has plummeted to half of what it was before the war. The space industry, which was once the pride of the country, is in deep trouble. Air transport has become quite dangerous due to a lack of maintenance, software updates and spare parts.

A major labour market crisis in Russia

Moreover, in a rapidly ageing country, where the population has already been declining since 2000, the exodus of hundreds of thousands of qualified young people after February 2022 in addition to hundreds of thousands mobilised, dead or disabled for life due to Russia’s war has opened a profound labour market crisis in Russia. In an attempt to mitigate this crisis, the Russian government had opened the gates to immigration from Central Asia. However, after the tragic terrorist attack on Crocus City Hall, for which Daesh has claimed responsibility, many of these migrants are being sent back home, thus aggravating the workforce crisis in Russia.

Due to its war against Ukraine, the Russian economy is more than ever highly concentrated on trading basic commodities, often at a discounted price, for medium and high-tech goods. China is using this situation of weakness to buy cheap oil from Russia and export more goods to Russia, which is becoming increasingly dependent on its big neighbour. Currently, roughly 50% of Russia’s imports come from China.

Russia’s economy is considerably weakened by our sanctions

In short, the belief that the Russian economy would be resilient to Western sanctions and that time favours Russia in its war of aggression does not stand up to scrutiny. If we do what is necessary to continue support Ukraine economically and militarily, in particular on the ammunition side, it can prevail. Russia, despite being three time more populated, is in reality already considerably weakened by our sanctions. Over time, their effect is set to be increasingly felt as human capital erodes, the volume and quality of investments deteriorate, and Russia is deprived of the advanced technologies needed to support its future.

MORE FROM THE BLOG

“A Window on the World” – by HR/VP Josep Borrell

Blog by Josep Borrell on his activities and European foreign policy. You can also find here interviews, op-eds, selected speeches and videos.